- Is there a canopy for senior residents? All insurance coverage corporations present a canopy for these above 60 years, however as age advances the premium will increase. “It’s because underwriting seems to be at insurance coverage cowl from the perspective of the well being of the person’’ says Lancelot Crasto, ex-head company insurance coverage Tata Metal and now Affiliate Accomplice New Age Safe Insurance coverage Advertising LLP. Some corporations like Tata AIG think about folks above 70 years as senior residents and never above 60. Most frequently corporations present cashless hospitalization cowl and all the opposite advantages out there to youthful residents.

- What is roofed underneath journey insurance coverage? Journey insurance coverage covers various unexpected occasions like: Hospitalization bills (insurers present cashless cowl for hospitalization and reimburse OPD bills), private accident cowl, dental emergency cowl, lack of baggage, lack of passport, baggage delay, flight delay and cancellation and the transport of mortal stays within the unlucky case of dying. Many journey insurance coverage present providers like medical evacuation, which could be essential for those who’re in a distant space or if native medical amenities are insufficient. Most corporations cowl

COVID-19 and associated medical bills. Ambulance providers and 24/7 helpline numbers to assist the insured in troublesome conditions are supplied. Sudden coronary heart assaults, strokes and fractures are normally lined.

Nevertheless, you will need to have a look at the coverage intimately to grasp the extent of protection and exclusions if any. Says Amrish Dubey, Vice President, Journey Insurance coverage, Tata AIG Normal Insurance coverage, “It could appear to be the insurer is getting a big cowl, however there are limits and sub-limits for covers and you will need to examine that”.

- What shouldn’t be lined underneath journey insurance coverage? Normally journey insurance coverage doesn’t cowl any accident arising out of journey actions, any declare associated to consumption of medication and alcohol, any routine medical examination and pre-existing illnesses. The protection for pre-existing illnesses varies from firm to firm. Some insurance coverage suppliers might present protection with circumstances (an extended ready interval for reimbursement of bills) or cost a excessive premium. Coverage particulars are shared by most insurance coverage corporations on their web sites and you will need to examine these completely.

- What’s the Deductible? Fairly often insurance coverage covers could have limits and deductibles. Deductibles are the quantity which the insured particular person has to pay from his personal pocket. It is extremely necessary to look intently on the coverage and perceive the deductibles for the duvet you’re taking. Most covers may even have limits and sub-limits. It’s crucial to grasp these limits.

- Which corporations provide journey insurance coverage? A number of personal companies and PSU banks provide journey insurance coverage. A few of the extra recognized ones are Tata AIG, HDFC Ergo, ICICI Lombard, Bajaj Allianz, Digit Insurance coverage, Care Well being Insurance coverage, State Financial institution of India and Reliance Normal Insurance coverage.

- What’s the premium charged? Normally the premium charged will rely on

- Age of the insured: The premium charged for aged is greater than what’s charged for youthful travellers. That is because of the larger dangers hooked up with superior age. There isn’t any higher age restrict for receiving insurance coverage cowl, however the underwriting guidelines could also be restrictive for folks past 80 years.

- Nation visited and time interval: Premium charged for USA and Canada is larger than what’s charged for different international locations. Nevertheless, it’s advisable to take the duvet as medical bills in these international locations could be very excessive.

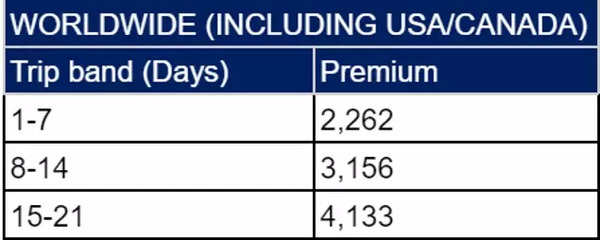

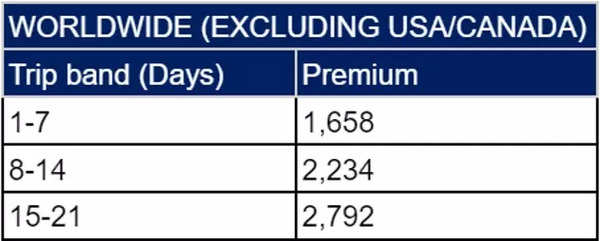

Here’s a pattern of the charges charged for the age band of 71- 75 years travelling to USA/Canada and to different international locations. It additionally exhibits how the variety of days travelled affect the premium.

Supply: Tata AIG; Sum Insured – USD 50,000; Charges with sub-limits.

- Covers opted for: The premium varies in line with the covers opted for. Says Girish Nayak, Chief, Know-how, Well being, Underwriting & Claims at ICICI Lombard, “Clients as much as 70 years of age can go for the Platinum plan, which incorporates all the great medical and non-medical coverages. Clients who’re 71 years outdated or above can go for the Senior Citizen plan.”

Says Parthanil Ghosh, President- Retail Enterprise, HDFC Ergo Normal Insurance coverage, “HDFC Ergo affords a Silver plan (Premium-INR 3772), Gold plan ( Premium-INR 4954) and a Platinum plan (Premium-INR 5945) underneath our Explorer journey insurance coverage plan. These charges are inclusive of GST and apply to a 61-year-old grownup for a 30-day single journey coverage to the USA with a sum insured of 1 lakh USD, excluding non-obligatory covers.”

Some companies provide further covers like Hijack Misery Allowance (an allowance if the plane is hijacked for greater than a sure variety of hours) and House Housebreaking Insurance coverage (Protection for housebreaking at dwelling when you are away).

- If you’re a frequent traveller, what plan do you have to take? It is sensible to purchase a multi-trip journey insurance coverage plan to be able to save each money and time. Moreover, for those who journey usually with your loved ones, it’s higher to purchase group plans as a substitute of particular person journey insurance coverage. Says Lancelot Crasto, “There may be an annual coverage for frequent travellers the place the premium is decrease than what you pay for a person cowl. If the insurance coverage firm asks for medical reviews, the identical maintain good for a time period, for those who take an annual coverage. So that you need not repeat assessments.”

“HDFC Ergo affords each single journey and annual multi-trip plans to senior citizen travellers, permitting flexibility primarily based on the frequency of journey,” says Parthanil Ghosh.

- Is Journey insurance coverage necessary? For international locations falling underneath the Schengen zone and for sure different international locations like Thailand, journey insurance coverage is necessary for getting a visa. Different international locations just like the USA and Singapore haven’t made it necessary. Nevertheless, increasingly more international locations are prone to make journey insurance coverage necessary. As Amrish Dubey says “No nation needs vacationers to get caught in a selected location, because of medical causes.”

Regardless of being moderately priced, vacationers usually have a look at journey insurance coverage as dispensable. “Individuals do not perceive the chance and insurance coverage penetration could be very miniscule, specifically for journey in Asia”, says Amrish. This wants to alter.

- Is a medical check-up necessary? Medical check-ups are normally not required for getting journey insurance coverage. Nevertheless, a senior citizen (and nobody for that matter) ought to journey towards the physician’s recommendation. It’s important to declare a pre-existing illness because the premiums are calculated accordingly. In some instances extreme sickness arising out of pre-existing illnesses could be lined in case they’ve been declared.

- Why the community of hospitals is necessary? Whereas taking journey insurance coverage it is rather necessary to examine the community of hospitals listed and to grasp how effectively their cashless system works. “Right here you will need to know the overseas associate of the Indian insurance coverage firm and examine their effectivity in settling claims,” says Lancelot Crasto.

Regardless of all of the laborious work that insurance coverage corporations are doing there are some areas they want to have a look at to make journey for the aged simpler. Says a Delhi primarily based psychological well being skilled “My mom is 85 years outdated and she or he wished to journey to the US to be along with her brother, however getting journey insurance coverage for her was costly. Lastly, we bought a canopy, however the medical bills weren’t reimbursable within the US. So, in case of hospitalization, her family members would have needed to bear the associated fee and she or he might reimburse them solely on coming again to India.”

So, it is essential for everybody, specifically seniors, to examine the small print when taking a journey coverage as ‘The satan is at all times within the particulars’. Nonetheless, do take a journey insurance coverage coverage when going abroad and luxuriate in your journey peacefully!