In right this moment’s Finshots, we clarify why the federal government is introducing a brand new set of taxes on overseas journey.

The Story

“Greater than 3 crore went overseas for enterprise or as vacationers…However the scenario is such that out of a inhabitants of greater than 130 crore, just one.5 crore have paid revenue tax.”

That’s what Prime Minister Narendra Modi stated in 2020.

Minimize to right this moment and the federal government has determined to take issues into its personal arms to repair what it thinks is an issue. It’s not going to attend for these vacationers to return again and file their taxes. Moderately, ranging from July, it’s going to gather an enormous 20% tax as quickly as certainly one of these vacationers swipe their bank card exterior of India.

Yup!

How will this work?

Hypothetically, let’s say you journey to Europe and need to purchase a pack of chewing gum. It prices a euro or ₹90. You swipe your bank card and go about your day. At night time, whenever you take a look at your unbilled transaction, you discover there’s a further cost of ₹18 too. There’s a be aware subsequent to it — “In the direction of Tax Collected at Supply (TCS)”.

Mainly, the federal government requested the financial institution to do the soiled work, observe your spending, and accumulate a tax everytime you spend cash overseas. The financial institution takes the tax and offers it straight to the federal government.

It’s not an revenue tax. It’s an expense tax!

Now let’s make one factor clear. This resolution wasn’t actually stunning. As a result of the federal government has been on a TCS spree of types. They’d already upped the tax from 5% to twenty% in the event you have been sending cash overseas (or utilizing a debit or foreign exchange card even). However with a purpose to carry bank cards into this ambit, it first needed to tweak a two-decade previous regulation.

You see, we Indians can’t merely take {dollars} overseas. Now we have to abide by the Liberalized Remittance Scheme (LRS) with a $250,000 cap every year. For those who spend greater than that exterior the nation, you want permission from the Reserve Financial institution of India. Nevertheless, all these years, bank cards have been exempt from this rule. It wasn’t an oversight. It was a particular exemption listed as Rule 7 within the lawbook. However this allowed the ultra-rich to buy groceries utilizing their bank cards exterior of India and get away with the $250,000 restrict.

So the federal government requested the RBI to tweak the rule. As a result of why ought to bank cards have all of the enjoyable, proper?

However that is going to have a ripple impact now.

Firstly, think about the headache for banks. Card transactions aren’t like sending cash by way of web banking. Every time somebody swipes a bank card, it provides to the banks’ compliance to-do checklist. A espresso at 8:00 am, a sandwich at 9:00 am, a pack of gum at 11:00 am — every time, the financial institution’s methods need to kick into motion. They should rejig just a few issues to be sure that the tax is collected in an orderly method as prescribed by the federal government.

Then, there’s you. Every thing is now costlier and there’s a chance price too. As an illustration, in the event you journey exterior and swipe your card for ₹3 lakhs, you’ll find yourself giving the federal government an additional ₹60,000 instantly. And that cash is put aside for some time till you declare it again. You may’ve invested this cash elsewhere. However alas, that received’t be potential now.

The one clear winner is the federal government. For them, it’s a bonanza. See, between April and February of FY23, we spent over ₹90,000 crores on abroad journey. This was 100% greater than the earlier yr. Think about a 20% tax collected on this spending. That’s some huge cash.

Now the federal government won’t be able to maintain all of this cash. They must refund a few of it in case you don’t fall underneath the 20% tax slab. However, in the event you’re a salaried particular person your cash shall be tied up till you modify it in opposition to your tax legal responsibility whenever you file your returns. If there’s a refund concerned then you’ll have to wait some extra time for the federal government to course of it. As an illustration, in the event you journey in July 2023, the refund will solely hit your account in say August 2024.

Retired of us with no tax legal responsibility might also need to bear the results as they need to put aside bigger sums of cash to easily go on trip. Then they await the refund too.

However wait…doesn’t the federal government additionally need to pay curiosity with the refund?

Effectively, Gautam Nayak of CNK & Associates LLP factors out, the curiosity calculation solely comes into impact for a really brief interval — “solely from the start of the following [financial] yr until the date that he [the traveller] will get his refund.”

No marvel then that the federal government has more and more been counting on taxing folks at supply. In actual fact, 40% of its whole tax assortment nowadays comes from taxes collected on the supply. They need the cash. They usually need the cash now!

Anyway, earlier than we wind up, there’s one very last thing to deal with. Bear in mind how we began the story — the quote from Narendra Modi who couldn’t consider that there was such a large gulf between those that travelled internationally and people who paid revenue tax?

Effectively, whereas it would appear to be a real downside, it isn’t actually that stunning.

Say you’re younger and earn ₹6 lakhs per yr. You save up cash for a few years and now you have got ₹2 lakhs to lastly take that 2-week journey to Vietnam. You’re a world traveller. However, as per the most recent tax guidelines, you don’t need to pay any revenue tax. Your revenue is beneath the taxable restrict.

Paradox solved.

However now, as a non-income taxpayer, you’ll nonetheless find yourself shelling out 20% tax. And then you definitely’ll need to patiently await the refund to hit your account. It’s not a fantastic feeling.

Till then…joyful travelling!

PS: The one two classes that get an exemption from this huge enhance in TCS are if the transactions are for training and medical causes. In these circumstances, the TCS stays at 5% over a threshold of ₹7 lakhs. And if it’s an training mortgage, it’s even decrease at 0.5%.

Additionally, will TCS be relevant in the event you sit in India and use your bank card to make a world buy? Say a subscription to ChatGPT? Effectively, if the acquisition is in some other foreign money apart from the Indian rupee, then sure, there’ll doubtless be a TCS. However in the event you’re shopping for a subscription to Spotify or Netflix and also you’re charged in rupees, then there will not be a TCS on that. Enterprise transact

Do not forget to share this text on WhatsApp, LinkedIn and Twitter

Time period life insurance coverage costs are rising!

A distinguished insurer is trying to enhance their time period insurance coverage charges within the subsequent few weeks.

For some context: whenever you purchase a time period life product, you pay a small price yearly to guard your draw back. And within the occasion of your passing, the insurance coverage firm pays out a big sum of cash to your loved ones or your family members.

The most effective half? Once you purchase early, you’ll be able to lock in your premiums to make sure they don’t seem to be affected by any future fee hikes.

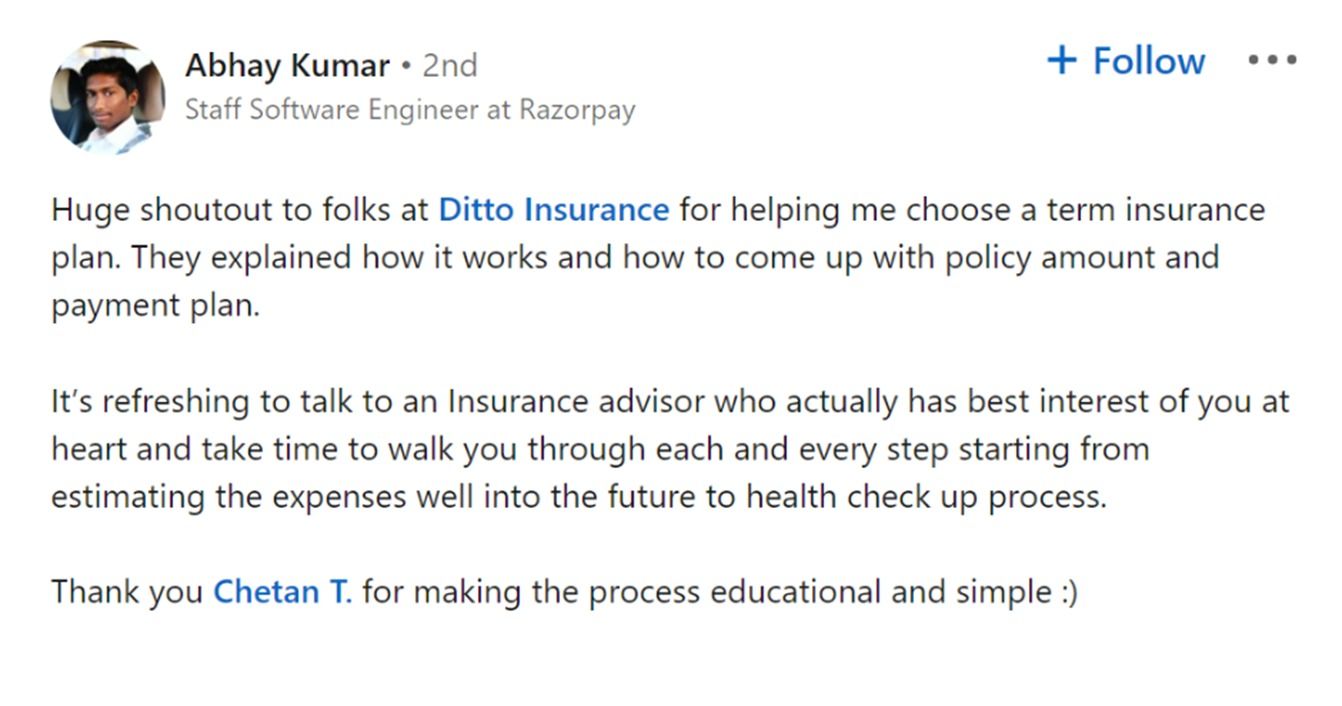

So, in the event you’ve been considering of shopping for a time period plan, now is likely to be the perfect time to behave on it. And that will help you within the course of, you’ll be able to depend on our advisory staff at Ditto.

Head to our web site by clicking on the hyperlink right here

Click on on “Guide a FREE name”

Choose Time period Insurance coverage

Select the date & time as per your comfort and RELAX!

Adblock check (Why?)