EaseMyTrip generates over 90 p.c of its income from airline bookings

EaseMyTrip generates over 90 p.c of its income from airline bookings

Picture: Avishek Das/SOPA Photos/LightRocket by way of Getty Photos

The Pitti brothers have at all times had an entrepreneurial streak in them. It was again in class, lengthy earlier than India’s digital revolution bought underway and video content material turned available throughout cell phones, that the brothers honed their entrepreneurial abilities.

Nishant and Rikant Pitti, the youngest of the siblings, would obtain films and promote these CDs to their classmates at a time when the movie trade was troubled by piracy. It’s one other story that, years later, additionally they dabbled in producing Bollywood films, and wouldn’t have appreciated anyone downloading and distributing their films.

The sons of a coal dealer, the trio grew up in a fairly modest family in jap New Delhi and have been fairly inseparable, persevering with to reside collectively in a joint household comprising 14 folks.

As we speak, the brothers, Nishant, Prashant, and Rikant, run EaseMyTrip, which has emerged as India’s second-largest on-line journey company with a market capitalisation in extra of Rs 7,500 crore. That’s fairly an exceptional achievement, particularly because the firm was just about unknown to many till just a few years in the past, and even managed the feat with none funding from enterprise capitalists.

“Nishant and Rikant had been at all times entrepreneurial,” says Prashant, a co-founder at EaseMyTrip and essentially the most studious among the many three. “They had been attempting to do various things at totally different occasions.” Prashant, in the meantime, went to review electrical engineering on the IIT-Madras whilst his brothers had been busy organising a journey company.

Prashant Pitti, co-founder, EaseMyTrip

Prashant Pitti, co-founder, EaseMyTrip

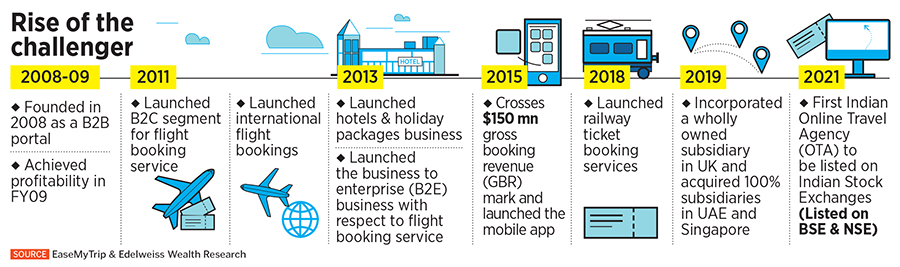

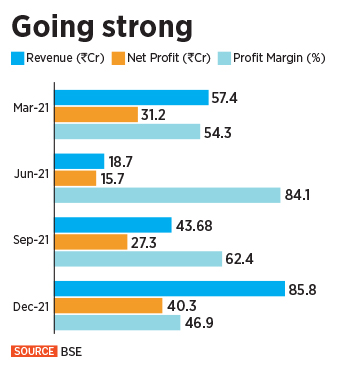

As we speak, EaseMyTrip has an annual income of Rs 150 crore, with earnings of Rs 62 crore, and generates over 90 p.c of its income from airline bookings. In 2021, EaseMyTrip turned the primary Indian On-line Journey Company (OTA) to be listed on Indian bourses. The corporate doesn’t cost a comfort charge that has come to outline the web journey company area and claims to be the second-largest on-line journey agent after MakeMyTrip.

“EaseMyTrip is the quickest rising and solely worthwhile firm within the on-line journey portal in India,” brokerage agency ICICI Direct Analysis mentioned in a report final month. “Lean price mannequin and no comfort charge technique stay key pillars supporting such fast, worthwhile development. This has additionally led to stickiness by prospects with a wholesome repeat transaction price of 86 p.c within the B2C channel.”

“There are 11 or 12 new-age firms in India, and we’re one among them,” Prashant says. “However most of those new-age firms are loss-making in lieu of development whereas EaseMyTrip is rising quick and profitably. I’m already at pre-pandemic numbers and my final quarter GMV was Rs 1,290 crore, which was my highest ever. Clearly, we should have eaten market share.”

Over the previous three months, the corporate has accomplished three acquisitions because it appears to be like to increase its enterprise—from focusing solely on airline journey to areas equivalent to inns, bus, and rail reserving. In November final yr, the corporate acquired Spree Hospitality, which has a community of inns in Bengaluru, Mumbai, Pune, Chennai, Goa, Hyderabad, Kochi, Manali, Amritsar, Dehradun, Coimbatore, and Delhi, amongst others.

Only a month earlier than that, it acquired B2B journey market Traviate, which operated with over 1.2 million inns and enabled some 200,000 transactions. Then, in December, the corporate acquired YoloBus, an intercity mobility platform. “Worldwide journey has not returned but,” provides Prashant. “Pre pandemic, our home and worldwide break up was 80:20. Proper now it should be 96:4. We’ve got grown a lot in home that it might compensate for my worldwide enterprise.”

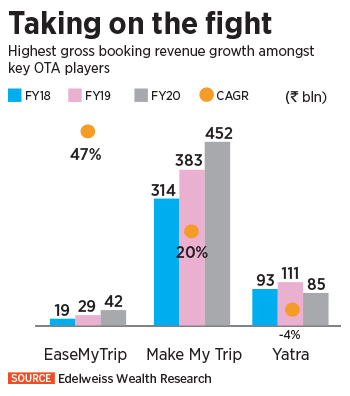

“Whereas EaseMyTrip has the biggest agent community within the Indian OTA trade, it additionally ranks second when it comes to air ticket quantity and third when it comes to gross reserving income (GBR) and quite a few registered prospects,” brokerage agency Edelweiss Wealth Analysis mentioned in a report. “Over FY18-20, the corporate recorded the best development in air ticket reserving quantity (47.7 p.c CAGR) and air ticket gross reserving income (50 p.c CAGR) amongst key OTAs in India.”

Humble beginnings

Based in 2008, EaseMyTrip (EMT) initially commenced as a B2B enterprise that supplied a platform for journey brokers to promote air tickets. It was additionally a time earlier than on-line journey brokers discovered momentum in India, and customers had been closely depending on journey brokers to do bookings.

A number of years earlier than that, Nishanth and Rikant had began a small mom-and-pop journey company referred to as Duke Journey Company. “Throughout that point, my brothers discovered lots of ache factors that may very well be solved utilizing expertise,” Prashant says. In 2008, with Rs 15 lakh as capital, the brothers arrange EaseMyTrip largely to serve journey brokers.

At the moment, Prashant says, journey brokers needed to pay up some Rs 30,000 to airways as advance. “If there are ten airways, a capital of Rs 300,000 will likely be caught,” he provides. That’s how the brothers got here up with the thought of EaseMyTrip. “The answer was that EaseMyTrip will combine with all of the airways, and journey brokers wanted to make use of EaseMyTrip and put solely Rs 20,000. So, their capex reduces dramatically. Additionally, our providing was that we are going to pay the fee to them since we had been aggregating a bunch of them.”

The brothers began off the journey of their one-bedroom condominium the place they grew up and transformed it right into a small workplace. The primary six months had been fairly difficult and, at one level, the corporate was virtually on the point of a collapse when one of many journey brokers duped the corporate by reserving air tickets utilizing pretend bank cards. The bootstrapped firm encountered a lack of Rs 26 lakh in a single day.

The brothers began off the journey of their one-bedroom condominium the place they grew up and transformed it right into a small workplace. The primary six months had been fairly difficult and, at one level, the corporate was virtually on the point of a collapse when one of many journey brokers duped the corporate by reserving air tickets utilizing pretend bank cards. The bootstrapped firm encountered a lack of Rs 26 lakh in a single day.

“We didn’t quit and considered giving it one other shot. We borrowed some cash and our father additionally supported us,” says Prashant. “Since then, we’ve ensured that EaseMyTrip by no means involves the brink of chapter. That was our first and final mistake.”

Of the fee they bought from the airways, EaseMyTrip stored one p.c and handed the remaining to the brokers. “We weren’t being profitable,” says Prashant. “If I am getting 8 p.c from the airways and I am giving 6.5 p.c to the journey agent, inside that 1.5 p.c, I’ve to handle my operations, my server price, my worker price, and all the things. Which is why, I needed to do lots of issues very in another way, in comparison with what all people else was doing.”

By 2011, the web journey firm pivoted to a customer-facing enterprise, and with well-established gamers round, the corporate was additionally below extreme strain to make a differential providing. “After we bought into the B2C market, we noticed our rivals weren’t solely getting the margin from the airways however they had been additionally getting comfort charges from prospects,” says Prashant. “Suppose from my perspective, B2C was not my major enterprise—it was the journey agent enterprise. So I did not should focus a lot on it.”

The ‘no comfort charge’ coverage labored fairly properly for the corporate, and with word-of-mouth, they began getting extra customers on their platform. The corporate claims to have had an over 80 p.c repeat transaction price within the final 5 years. “What really helped us to develop was our rivals attempting to exploit some extra money on the final step,” says the 37-year-old.

The large break

The large break, nevertheless, got here in 2016. “From 2016 until 2020, we grew at greater than 50 p.c per yr in our B2C enterprise,” Prashant says. “So, the curve may be very alike VC-funded curve. Our development got here slowly at first, however it exploded within the latter half. As increasingly more word-of-mouth unfold, we bought to a tipping level in 2016.”

In 2020, because the pandemic hit, Prashant says the corporate benefitted largely from the mess that Indian aviation underwent with cancellations. By then, virtually 94 p.c of the enterprise was consumer-focussed with the remaining coming from journey brokers. “Previous to the pandemic, we had been the third largest. However, simply after the primary wave, I turned the second largest.” A lot of that, he feels, was because of a aware choice to repay travellers from their kitty as in opposition to a credit score shell provided by airways.

In 2020, because the pandemic hit, Prashant says the corporate benefitted largely from the mess that Indian aviation underwent with cancellations. By then, virtually 94 p.c of the enterprise was consumer-focussed with the remaining coming from journey brokers. “Previous to the pandemic, we had been the third largest. However, simply after the primary wave, I turned the second largest.” A lot of that, he feels, was because of a aware choice to repay travellers from their kitty as in opposition to a credit score shell provided by airways.

“All people was screaming for refunds and airways weren’t giving refunds in exhausting money,” says Prashant. “Airways had been saying I’ll preserve the cash in your pockets for everytime you need to ebook it subsequent time. This was the established order all people was following. EaseMyTrip had about Rs 200 crore within the checking account at the moment. We determined to shell out Rs 110 crore to present prospects exhausting money, and never a credit score shell.”

That transfer led to humongous goodwill for the corporate and likewise labored out properly when it comes to the stability sheet as not one of the airways went bankrupt and “we bought the cash after 2-3 months”.

As we speak, at 60,000-odd, EaseMyTrip has the biggest community of journey brokers throughout virtually all main Indian cities—the quantity is greater than each MakeMyTrip and Yatra. “EaseMyTrip has been worthwhile since inception and is the one worthwhile participant amongst key OTAs in India,” Edelweiss mentioned within the report.

“It is ‘No Comfort Price’ technique, which attracts a lot of prospects, primarily need-based travellers which account for 1/third of home air travellers,” says Pravin Sahay, a analysis analyst at Edelweiss wealth administration. “The corporate has a lean price construction, which has enabled it to stay worthwhile even in difficult occasions, particularly when friends (together with trade chief) have suffered losses.”

Take, for example, the corporate’s transfer to shift in the direction of a WhatsApp-led buyer care centre in comparison with a dial-in. Throughout the first wave, when the nation went into lockdown and places of work had been shut, Prashant says the corporate was flooded with calls from prospects who wished to know the standing of their reserving. “Throughout the pandemic, we had been obtainable to customers whereas no one else was in a position to serve them.”

By Prashant’s estimates, calls through the pandemic had been up 10x, whereas, on the identical time, name abandonment too rose considerably. “All a buyer wanted to listen to was, ‘please be affected person’, issues will get again to regular,” he says. However with huge name drops and abandonment, they weren’t getting that assurance too. That’s when EaseMyTrip built-in WhatsApp into their system whereby a name is disconnected and the caller is directed to a WhatsApp-based chat.

“This technique is reside even proper now,” says Prashant. “We don’t voluntarily minimize the decision, however 37 p.c of all my queries are solved on chat, not on name. Earlier, one agent was talking to at least one buyer at a time, however now one agent is chatting with eight prospects concurrently. Due to this, I used to be in a position to scale back my name centre crew from 200 to 110 folks, which created large financial savings for the corporate.”

Within the meantime, the corporate additionally fortified its backend, hiring folks and investing in expertise to make sure a leaner organisation. “Throughout the pandemic, whereas all people was shedding folks, we had been hiring folks in expertise. We elevated our expertise crew from 45 folks to 75,” says Prashant. “Earlier, I used to have a rescheduling crew of 40 folks. Throughout the pandemic, utilizing machine studying, we automated as a lot as attainable and now I solely have 3-4 people who find themselves fixing the circumstances for rescheduling.”

Then, as airways and inns struggled with a money crunch, the Pitti brothers, who declare to have a behavior of investing all the cash again into the corporate, used their reserves to barter higher reductions with airways. The corporate at present has some Rs 250 crore in reserves.

“However all that cash is coming from the earnings which we’ve got amassed for the final 13 years,” says Prashant. “It is not our ancestral cash. It is not the cash that VCs pumped in. Airways and inns had a extreme money crunch throughout July and August final yr. They had been longing for money. In the event you see our stability sheet, earlier than the pandemic, I had a restricted variety of advances given to the airways. However in case you see my September 2021 numbers, you will notice I’ve given someplace round Rs 130 crore as advance to the airways.”

“However all that cash is coming from the earnings which we’ve got amassed for the final 13 years,” says Prashant. “It is not our ancestral cash. It is not the cash that VCs pumped in. Airways and inns had a extreme money crunch throughout July and August final yr. They had been longing for money. In the event you see our stability sheet, earlier than the pandemic, I had a restricted variety of advances given to the airways. However in case you see my September 2021 numbers, you will notice I’ve given someplace round Rs 130 crore as advance to the airways.”

“I consider the corporate’s focussed strategy in the direction of particular segments, lean price construction, and asset-light mannequin will play out in future as properly,” Sahay of Edelweiss tells Forbes India. “I anticipate the corporate to proceed to achieve market share within the home air journey market and introduce new verticals via inorganic methods to ship wholesome profitability within the coming years. I estimate the corporate to ship a income and revenue CAGR of 62 and 67 percents, respectively, over FY22-24.”

Final March, EaseMyTrip turned the primary on-line journey company to go public. The corporate made its inventory market debut at a ten p.c premium to the IPO value of Rs 206 per share. Throughout the bidding course of, Simple Journey Planners, the mum or dad firm of EaseMyTrip, noticed large curiosity from traders, with the subscription tally hovering to 159 occasions. The corporate had initially deliberate on itemizing in March 2020 at a valuation of Rs 4,500 crore, however the onset of Covid-19 delayed that plan. The second time, the valuation was almost Rs 3,000-3,500 crore, however indications of a second wave had left EaseMyTrip with solely two choices—delay the IPO or go for a decrease valuation.

Because the second wave hit, the corporate determined to go forward with its plan at a decrease valuation of Rs 2,000 crore. The 13-year-old firm sits on a market cap of Rs 7,600 crore, as of March 30. The brothers personal a 75 p.c stake within the firm and, final yr, provided bonus shares within the ratio of 1:1 out of its free reserves.

Taking over the giants

As we speak, EaseMyTrip additionally ranks second when it comes to air ticket quantity and third when it comes to gross reserving income and the variety of registered prospects. The corporate has additionally seen its registered buyer develop at a CAGR of 21 p.c up to now three years.

“EMT has achieved the quickest development in gross reserving income (GBR) throughout pre-Covid ranges with air ticketing section reporting CAGR of 46.3 p.c throughout FY18-20, versus high two gamers mixed CAGR of 13.9 p.c throughout the identical interval,” ICICI Securities mentioned in a report. “Market chief MakeMyTrip (51 p.c market share) reported a CAGR of 19.7 p.c in GBR whereas Yatra reported 1.1 p.c de-growth throughout the identical interval. The market measurement of the highest two gamers was at 14x of EMT in FY18. It has now declined to three.1x of EMT as of FY21. This means that the corporate has continuously gained presence and market share (now second largest with 19 p.c market share) within the home air-ticketing area because of its lean price mannequin and no comfort charge technique.”

India’s journey market is value a staggering Rs 2.58 lakh crore of which nearly 50 p.c is air journey reserving, whereas 29 p.c is in resort reserving. The remainder comes from rail and bus bookings. Of the air journey reserving market, about 70 p.c is in on-line air ticketing, offering an enormous potential for the likes of EaseMyTrip to faucet into.

The web journey market, in the meantime, is predicted to double over the following 5 years, from $16 billion in 2020 to $31 billion by 2025 at a CAGR of 14 p.c. “We consider the low-cost mannequin and the no comfort charge technique would strongly assist the corporate in gaining market share farther from rivals, going forward,” ICICI Direct says.

In 2020, the corporate additionally unleashed a marketing campaign, rallying on the patriotic fervour amidst the banning of Chinese language apps within the nation. “Since EaseMyTrip was 100% Indian, we bought 90-plus celebrities sharing the message that Indians spent Rs 7 lakh crore on holidays,” says Prashant. “Why not spend that cash on an Indian firm.” It additionally helped that the Pitti household has a fairly shut reference to Bollywood.

For six years, between 2014 and 2020, the brothers dabbled in producing films, together with the likes of Manikarnika: The Queen of Jhansi, and Fanney Khan. The choice to foray into movie producing was largely to assist promote the EaseMyTrip model via product placement. “However we’ve got stopped that now.”

“Prior to now, EaseMyTrip was concerned in lots of unrelated loss-making companies like coal buying and selling, share buying and selling, and film manufacturing,” Edelweiss says in its report. “If comparable endeavours are undertaken sooner or later, it could dent earnings in addition to the corporate’s market notion.”

Already, the corporate has begun to observe its friends because it appears to be like to faucet into the broader market. The corporate now fees a comfort charge every time a buyer makes use of a reduction coupon on the platform.

“We like EaseMyTrip for its user-friendly platform, distinctive journey choices, low-cost mannequin,

and wholesome monetary place. The corporate is persistently gaining market share led by its two sturdy development pillars and is now properly positioned to face up to any competitors which can come up sooner or later given the sturdy liquidity and its bettering model visibility within the home air ticketing section,” Rashesh Shah, an analyst for ICICI Direct Analysis, mentioned in a current report.

Now, with worldwide air journey bookings resuming after a two-year lockdown, the corporate is gearing as much as faucet into the rising section. As well as, the corporate can be increasing its international footprint, from its present presence within the UAE, Singapore, the UK, the Philippines, Thailand, and the USA. “The journey on this new period has been redefined by new tendencies principally round security and expertise,” says Shah. “Therefore, we anticipate the corporate’s enterprise quantity to additionally develop at very wholesome price going ahead. It is usually increasing enterprise within the worldwide markets like UAE, Singapore, UK, Philippines, Thailand, and the US in order to faucet the chance from large anticipated pent-up international demand for the journey and tourism as properly within the coming months.”

For now, Prashant says, all their consideration is on rising the enterprise and making it the frontrunner in India’s OTA market. “I am buying firms within the non-air area to develop. My non-air enterprise is organically rising 2.5x yearly. It is simply that the tempo is sluggish as a result of all of us began this 4-to 5 years in the past. However, one huge acquisition and this could change dramatically.”

What are the brothers now wanting ahead to because the Indian journey trade emerges out of the shutdown? “We is not going to shrink back from utilizing the cash when an opportune time arrives,” says Prashant. “We preserve our ear very near the bottom and we react shortly which permits us to take sooner selections and keep forward of our rivals.”

Click on right here to see Forbes India’s complete protection on the Covid-19 scenario and its affect on life, enterprise and the financial system

Try our finish of season subscription reductions with a Moneycontrol professional subscription completely free. Use code EOSO2021. Click on right here for particulars.